Not known Incorrect Statements About Feie Calculator

Feie Calculator Fundamentals Explained

Table of ContentsSome Ideas on Feie Calculator You Should KnowThe 8-Second Trick For Feie CalculatorWhat Does Feie Calculator Mean?Fascination About Feie CalculatorSome Of Feie Calculator

Initially, he marketed his united state home to develop his intent to live abroad permanently and obtained a Mexican residency visa with his better half to aid accomplish the Authentic Residency Examination. Furthermore, Neil safeguarded a lasting residential property lease in Mexico, with plans to eventually acquire a residential or commercial property. "I currently have a six-month lease on a residence in Mexico that I can expand one more six months, with the purpose to buy a home down there." Nonetheless, Neil mentions that purchasing home abroad can be testing without very first experiencing the location."It's something that people need to be truly diligent concerning," he states, and recommends expats to be cautious of usual errors, such as overstaying in the U.S.

Neil is careful to mindful to Tension tax authorities tax obligation "I'm not conducting any business any kind of Company. The United state is one of the few nations that taxes its people regardless of where they live, suggesting that even if a deportee has no earnings from U.S.

tax returnTax obligation "The Foreign Tax Debt permits individuals working in high-tax nations like the UK to offset their U.S. tax obligation obligation by the amount they have actually already paid in tax obligations abroad," states Lewis.

5 Simple Techniques For Feie Calculator

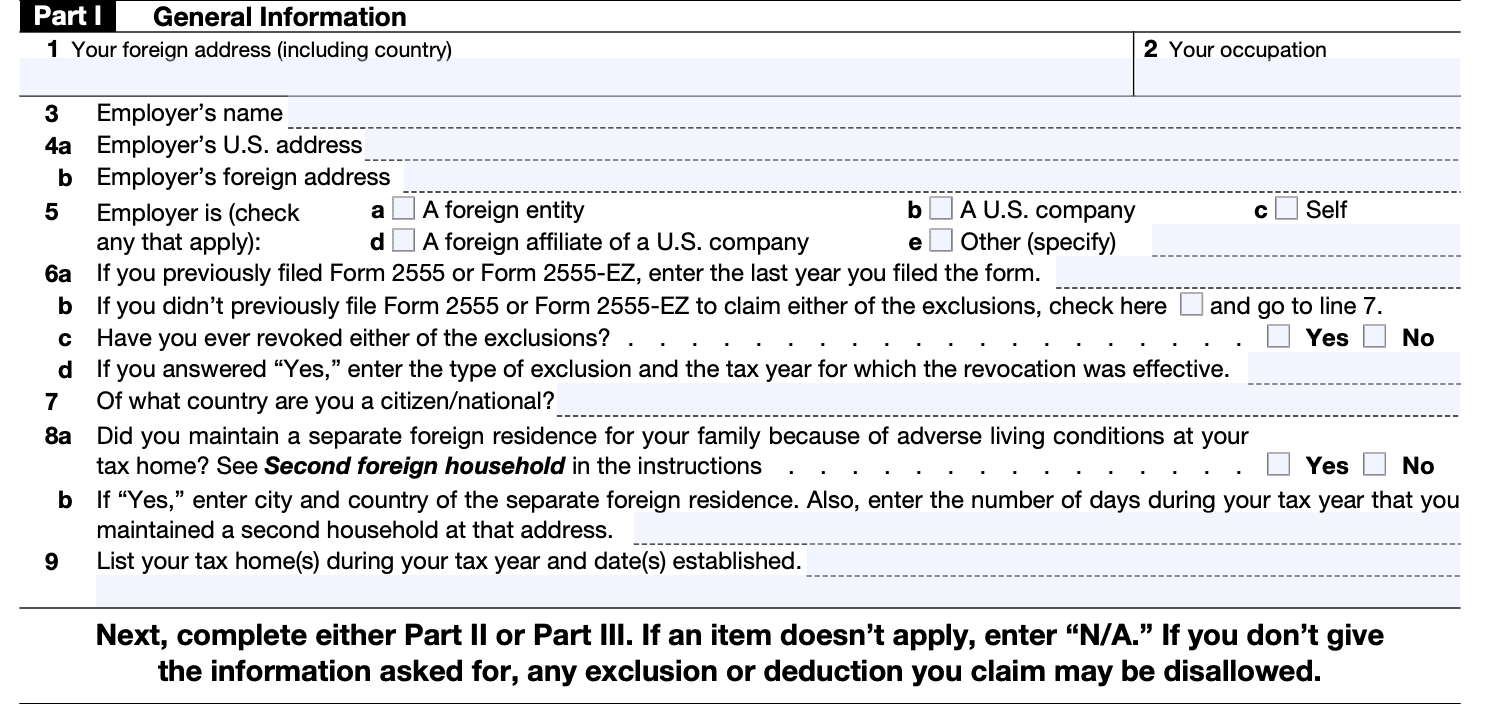

Below are some of the most often asked inquiries concerning the FEIE and various other exemptions The International Earned Income Exclusion (FEIE) allows U.S. taxpayers to leave out approximately $130,000 of foreign-earned income from federal income tax, decreasing their U.S. tax obligation. To receive FEIE, you have to fulfill either the Physical Visibility Examination (330 days abroad) or the Authentic Residence Test (show your key house in an international nation for a whole tax obligation year).

The Physical Presence Test requires you to be outside the united state for 330 days within a 12-month duration. The Physical Visibility Examination additionally requires U.S. taxpayers to have both a foreign income and a foreign tax home. A tax home is specified as your prime area for service or work, no matter of your family members's house.

Not known Details About Feie Calculator

A revenue tax treaty in between the U.S. and an additional country can aid avoid dual taxation. While the Foreign Earned Earnings Exclusion minimizes taxable earnings, a treaty might provide fringe benefits for eligible taxpayers abroad. Website FBAR (Foreign Financial Institution Account Report) is a called for declare U.S. people with over $10,000 in international monetary accounts.

Qualification for FEIE depends on meeting certain residency or physical visibility tests. He has over thirty years of experience and now specializes in CFO services, equity payment, copyright taxation, marijuana tax and divorce relevant tax/financial planning matters. He is a deportee based in Mexico.

The international earned revenue exclusions, occasionally referred to as the Sec. 911 exclusions, omit tax obligation on salaries gained from working abroad.

Not known Details About Feie Calculator

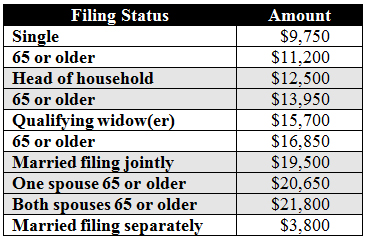

The earnings exemption is currently indexed for rising cost of living. The maximum annual earnings exemption is $130,000 for 2025. The tax obligation advantage excludes the earnings from tax obligation at lower tax obligation prices. Previously, the exclusions "came off the top" minimizing revenue based on tax on top tax prices. The exclusions may or may not decrease earnings utilized for various other purposes, such as IRA limits, child credit reports, individual exceptions, and so on.

These exclusions do not excuse the salaries from US taxation but just give a tax obligation decrease. Keep in mind that a bachelor working abroad for all of 2025 who gained concerning $145,000 without various other earnings will have gross income reduced to zero - efficiently the exact same solution as being "free of tax." The exclusions are calculated daily.